The Citizens Equity First Credit Union (CEFCU) routing number is 271183701. The credit union is based in Peoria, Illinois, for current and retired employees of Caterpillar, as well as individuals who live and work in certain counties in Illinois and California. If you live or work in the following counties, you may be eligible for a CEFCU account.

In Illinois:

- Fulton;

- Knox;

- Livingston;

- Logan;

- McLean;

- Macon;

- Marshall;

- Mason;

- Peoria;

- Putnam;

- Sangamon;

- Stark;

- Tazewell;

- Woodford.

In California:

- Alameda;

- Contra Costa;

- Santa Clara.

What Is a Routing Number?

A routing number, also known as the ABA (American Bankers Association) number, identifies your bank. It’s nine digits long and is used for transferring money between banks. No two financial institutions share the same number, although some banks have more than one ABA number.

You’ll need the CEFCU routing number to set up a direct deposit with your employer or to receive your monthly benefits. Besides receiving income, you can send money electronically. An electronic funds transfer (EFT) or wire transfer is a great alternative to writing and mailing a physical check because it’s usually faster and more secure than putting a check in the mail.

To send and receive money, you’ll need a bank account number and the routing number. The routing number tells a bank which financial institution the funds should go to. The bank account number instructs the bank which account holder the money belongs to.

Where Can You Find Your CEFCU Routing Number?

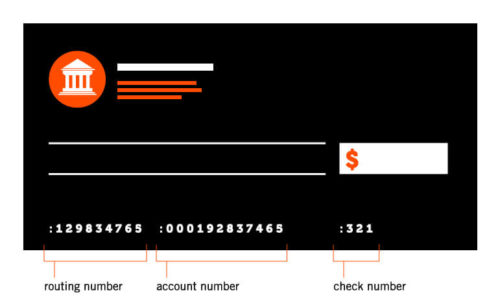

You can find your CEFCU routing number at the bottom of a check, right below the memo spot where you’d write the purpose of the check. You’ll notice a long string of numbers on the bottom of the check, grouped in three sections. The first nine digits are the routing number. The second string of digits, which can vary from 10 to 11 digits, is your account number. The last three or four digits are your check number, which should match the check number on the upper right-hand corner.

If you don’t have access to checks, bookmark this page for future reference, visit CEFCU’s website, or call customer service at (800) 447-2478.

Image Source: https://depositphotos.com/