Are you getting harassing calls from debt collectors? Did you find a collections account on your credit report, and you are wondering what is Sunrise Credit Services? Creditors hire Sunrise Credit Services to collect debts on their behalf.

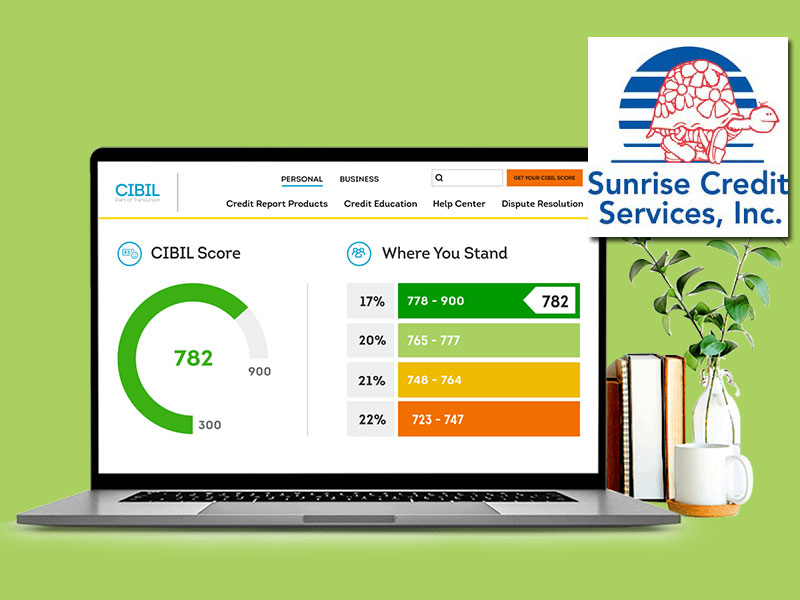

Collections accounts can stay on your credit report for up to seven years, and they can severely impact your credit score.

Not only do unpaid collections look bad to potential lenders, but agents will likely contact you regularly until you pay or settle the debt. Here is everything you need to know about Sunrise Credit Services and how to negotiate with them.

Table of Contents

What Is Sunrise Credit Services?

Headquartered in Farmingdale, New York, Sunrise Credit Services is known as a late-stage debt collector. Late-stage collectors purchase the right to collect past-due debts from the original creditors.

Sunrise Credit Services is a collections agency. Many creditors hire them to collect old debts that are severely past due. Sunrise often reports debts they attempt to collect to the credit bureaus. These tradelines are referred to as collections accounts.

On your credit report, Sunrise Credit Services may be listed as the creditor or the collections agency.

Why is Sunrise Credit Services calling me? Sunrise collects a variety of past due accounts, including:

- Credit card debt

- Personal loans

- Medical debt

- Payday loans

- Student loans

- Auto Loans

This is not a comprehensive list of debts Sunrise Credit Services purchases. It works with various creditors and may purchase the rights to any debt it thinks it can make money on.

Is Sunrise Credit Services Legitimate?

Sunrise Credit Services is a legitimate company. It has the right to purchase debt and contact consumers in an attempt to collect payments. Agents have access to consumer information, including contact information and personal financial data.

Although Sunrise is a legitimate collections agency, the company is not highly regarded by customers. Agents often use aggressive techniques to collect payments from customers.

However, agents must abide by debt collection laws outlined by the U.S. federal government.

Consumers should know their rights and report the company to the Better Business Bureau if agents use unlawful tactics. Consumers can even pursue legal action against collections agencies in certain circumstances.

Should I Negotiate a Settlement or Pay Sunrise Credit Services?

Unfortunately, paying a collections account in full or settling for a lesser amount will not help your credit. The collections account can stay on your report for up to seven years. And your credit score is not likely to increase after payment is made.

However, agencies must update your account as paid once you settle the bill.

Many people choose to negotiate with collection agencies, especially if the debt is old. Keep in mind that some future lenders may look more favorably upon a collections account if it is paid in full rather than settled for a less amount.

You may want to consult with an attorney or accountant before paying or settling an account.

How Can I Remove a Sunrise Credit Services Account From My Credit Report?

While removing a collections account from your credit report is difficult, it is not impossible. Negotiating with Sunrise Credit Services takes time, but it is better to handle the issue, so agents stop contacting you.

You may attempt the following tactics to get an account removed from your credit report:

Dispute the Account

You have the right to dispute an account if certain information is incorrect or the debt belongs to someone else. There are three main credit bureaus in the United States: Equifax, Experian, and TransUnion.

You must request a dispute with each credit bureau. Each bureau has its own dispute process so do your research before submitting your paperwork.

You can request to have the account removed from your credit report if it is older than seven years. Credit bureaus are legally obligated to remove delinquent accounts after a certain amount of time.

You can also dispute the account if the debt is not yours or if some information is incorrect.

Before submitting your dispute, gather as much documentation as possible to support your claim. Also, keep records of all communications with the credit bureaus and follow up regularly to check the status of the dispute.

Ask For a Goodwill Deletion

You can ask Sunrise Credit Services or the original creditor for a “goodwill deletion” once you pay the account. Write a letter explaining your circumstances and why you need the account deleted from the report.

Do not ask for a goodwill deletion if you have not paid off the account.

While there is no guarantee they will accept your request, there is no harm in making one. Your case may be assigned to a sympathetic agent. You may get lucky.

Request Pay for Deletion

Some collection agencies will delete the account from your credit report in exchange for full payment. Make sure you get the agreement in writing before making any payments, or there will be no proof of the arrangement.

While many agencies say they cannot process payments for delete arrangements, it is within their power to do so. Be persistent and consider hiring a professional to help you negotiate with the creditor.

Settle the Account

You can settle the account for less than you owe if Sunrise Credit Services will not remove it from your credit report. However, Sunrise must update the account as settled once you have paid the agreed-upon amount.

While the bill will stay on your account until the statute of limitations is up, agents will stop contacting you once the debt is settled.

Leave the Account Unpaid

What is Sunrise Credit Services, and do you have to pay them? You have the option to leave the account unpaid. Some people decide to do this if the account is old and will be removed soon due to the statute of limitations.

However, you should know the potential consequences of not paying the bill. The collection agency will continue to contact you, and you may be subject to legal issues.