It’s important to know how to balance a checkbook and to complete this task on a regular basis. While many are guilty of not balancing their checkbooks, failing to accurately record the amount of money currently available in your accounts can get you into financial trouble. If you make one small error while balancing your checkbook, it could cause both short- and long-term financial problems with your account.

Double-checking your work and paying close attention to your calculations can save you from thinking you have more or less money in your account than you do. Learning the proper techniques for balancing your checkbook and the benefits of doing so will help you stay motivated to consistently complete this important task.

Table of Contents

Step-By-Step Instructions on How to Balance a Checkbook

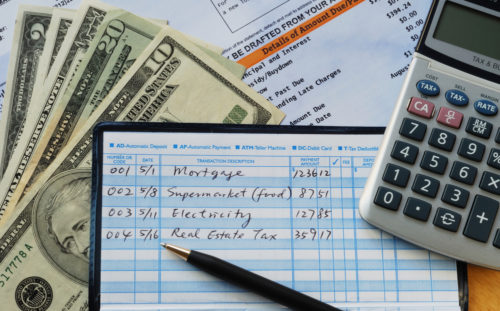

You’ll need to learn the steps to balancing your checkbook so you can keep track of the withdrawals and deposits in your account. This way, you’ll always know the current balance in your account and the money you have available. Your checkbook should come with a ledger for recording transactions.

Step One: Record Your Transactions

To balance your checkbook, you’ll need to have a detailed record of all the transactions that occurred in the account. For deductions, write down the date the money was paid, where the money went, and the total that was deducted. For deposits, write down the amount deposited, the source of the deposit, and the date it was deposited. Don’t forget to add in any banking or ATM fees.

Step Two: Review Your Monthly Bank Statements

When you receive your monthly bank statements, either online or by mail, you’ll need to review them against your personal records. Go through each transaction listed on your bank statement one by one. Ensure these transactions match, penny for penny.

Once you’ve completed your review, you’ll be able to identify any missing information you forgot to put in your recorded transactions. Add in any transactions you may have missed.

Step Three: Make Sure Your Personal Record and Bank Statements Match

If you notice that the ending balance in your personal record doesn’t match the ending balance of your bank statement, don’t panic. Keep in mind, some of your more recent transactions may still be pending.

These transactions may not show up on your bank statement because they haven’t technically been withdrawn or deposited into your account during the current statement period. They’re likely to show up on your next monthly statement after they’ve been completed. To make sure your statement and records match, you’ll need to take out any pending transactions that don’t show up on your statement.

Step Four: Address Any Errors

If you’ve taken pending transactions into consideration but your statement balance and personal records still don’t match, there may be an error. Go back through the transactions you recorded and the ones that show up on your statement. Make sure you didn’t miss something or calculate incorrectly on your personal records.

If you find a discrepancy in your bank statement, such as an erroneous or fraudulent charge, contact your bank immediately. You’ll need to speak with a representative in the bank’s fraud department so you can report a claim and request to have the charges removed from your account.

Step Five: Draw a Line Where You Finished Balancing

Draw a line under the last transaction you recorded in your personal records. You may also want to write the current date where you drew your line. This line helps you easily identify where to record your next transaction when you start your new statement period.

Step Six: File Your Statement

You should file your bank statements in a safe place where they’re neatly organized. Consider putting your statements in a file that’s organized by year. Since your bank statements are often used when filing your taxes, you may need these statements when you complete your tax return. The Internal Revenue Service (IRS) suggests keeping records that are associated with your tax return for at least three years.

The Benefits of Balancing Your Checkbook

Balancing your checkbook is another way to verify that your bank statement is correct. There are other benefits to performing this simple task because it allows you to:

- Keep a close watch on your account: If you keep a balanced checkbook, it’s easier to identify a fraudulent or erroneous charge quickly. Once identified, you can tell your bank about it and get it resolved fast.

- Avoid overdrafting: When you’re always aware of your account balance, down to the penny, you’re less likely to overdraft, which allows you to avoid overdraft fees and keep a better handle on your account.

- Identify bank charges and fees: If you don’t keep track of every transaction, monthly account fees and charges from your bank can easily slide by without notice. Keeping a balanced checkbook will help you identify these fees so you can discuss them with your bank and develop a strategy to avoid them.

- Support your savings goals: When you keep track of every transaction, you can be real with yourself about where your money’s going and how to rein in your spending. By taking control of your finances, you can put more money in your savings and reach your financial goals faster.

The checkbook balancing process is easier if you keep all your transaction receipts. This allows you to confirm how much money was spent on each transaction and can prevent any errors in your personal records.

While balancing your checkbook may seem like a thing of the past, there are many benefits to keeping these personal records. Knowing your account balance and identifying errors in your account is important to staying on track to reach your financial goals.

Image Source: https://depositphotos.com/