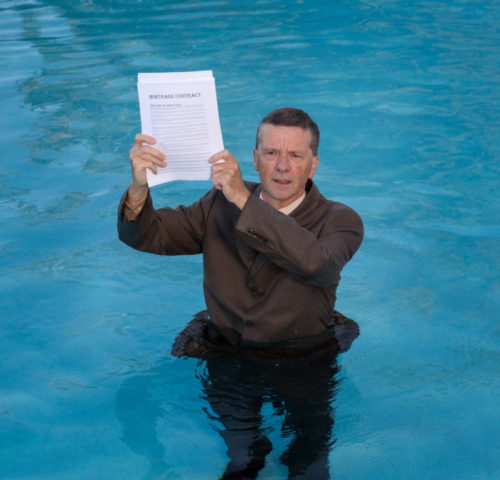

An underwater mortgage is when the balance on your mortgage is higher than the market value for your home.

A mortgage consists of principal and interest payments. The principal is the original amount that you borrow to pay for the home, while the interest is like a fee that you pay for the right to borrow the principal.

In an ideal situation, your home will increase in value, and the amount of principal will get lower as you make your monthly mortgage payments. If the real estate market crashes or if you paid too much for the property (more than the fair market value), you could end up with a home that has a lower value than the principal that you owe to the lender.

An underwater mortgage can cause a few different problems for homeowners. All these problems involve a lack of equity. Since you owe more than the home is worth, you may find it challenging to use your home as collateral.

Refinancing difficulties are common if you have an underwater mortgage. For example, if your home is worth $100,000 on the free market, but your mortgage principal sits at $120,000, your home’s value will not provide enough collateral to refinance.

In this example, you would have to pay $20,000 in cash to cover the difference between the value and the principal.

The problem can be even worse when you try to sell your home. If the selling price does not meet or exceed the principal that you still owe, you may not be able to sell, or you would have to pay the difference in cash to complete the sale.

Table of Contents

How You Can Tell If Your Mortgage Is Underwater

There are warning signs that will tell you if your mortgage is underwater or is in danger of going underwater. While an underwater mortgage does not mean that you will certainly lose your home or have to pay money out of pocket, it does mean that you need to take steps to address the situation before it becomes unmanageable.

The first step is to understand the warning signs.

Low Appraisal

In most jurisdictions, you get an appraisal on your home for tax purposes every year or two. If you want an accurate and up-to-date assessment based on market value, you can hire an independent appraiser.

You can compare the appraised value with the remaining principal of your mortgage. If the home value is significantly lower than the remaining principal, your mortgage is underwater.

An appraisal that takes market conditions into account is critical because it weighs the current economic circumstances. A home may have a different book value (or accounting value) than market value. When dealing with an underwater mortgage, you need to focus on the market value.

You should be able to see the remaining principal of your mortgage on your loan statement, your monthly bill, or an online portal where you make your monthly payments. You can also request a mortgage payoff quote, also known as a payoff statement, from your lender. This document will tell you how much of the principal is remaining on your mortgage.

Failing Local Property Prices

Property prices may fall in a specific area because of the local economy, zoning changes, or a change in demand. Luckily, this problem is relatively easy to spot on your own. You can use a real estate database or real estate listing sites to see the sales price of homes in your area.

You will want to look at comparable homes in your area. You compare the sales prices to the amount of principal remaining on your loan.

This research can help you see if the prices are going down locally. Also, if the real estate market regionally or nationally is struggling, you should see a downtick in the prices for homes in your area.

Though most people expect housing prices to rise gradually, they can fall in the short term. For example, in October 2008, the value of homes had dropped 18% compared to the previous year, according to a report by CNN Money. This nationwide real estate market crash in 2008 and 2009 caused a lot of underwater mortgages.

Other factors, such as a lowering of interest rates by the Federal Reserve, can also affect property values.

You’re Behind on Payments

In some instances, the real estate market does not cause an underwater mortgage. Missed payments could also create a problem. This predicament can be especially noticeable early in the mortgage payment process if you did not make a large down payment, or you got a large mortgage with monthly payments that are more than you can afford. Missed payments in the first few years of ownership can quickly cause your balance to rise above your home’s value.

If this issue gets combined with another one, such as falling or stagnant home values in your area, the difficulty could compound.

If you fall too far behind on your payments, you may risk foreclosure. However, most banks do not want to foreclose, so they often work with homeowners who are in this situation to help them make payments in a manageable way.

What to Do If Your Mortgage Is Underwater

If your mortgage is underwater, you can take several different steps to deal with the problem. While the situation is not ideal, you do have some different options to bring your mortgage back above water.

Continue Building Equity

You may believe that your mortgage is underwater because of a downturn in the real estate market. In the long run, you hope that the real estate market will correct itself, and your home will again increase in value.

This expectation is reasonable. Between 1968 and 2009, the average home value increased by 3.7% per year.

You can also build equity by making improvements to your property that increase the appraised value. The goal of waiting out a downturn is that your mortgage will eventually move above water as the market improves and your home equity increases. The drawback is that you may not be able to sell or refinance while you are waiting.

In some cases, waiting is not an option. During the real estate market crash of 2008, people who were close to retirement and waiting to sell their home as part of the retirement financial plan could not afford to wait for a market correction.

Refinance Your Mortgage

Refinancing through traditional means may not be possible if your mortgage is already underwater. However, if you have a good credit score and make the move to refinance early enough, you may qualify for some programs that help people with underwater mortgages.

As part of the response to the 2008-2009 housing crisis, the Federal Housing Finance Agency began the Home Affordable Refinance Program (HARP) specifically for those with underwater mortgages. The program allowed them to transfer or obtain mortgage insurance that can make refinancing possible by limiting the risk for the lender.

After this program expired in 2018, federal mortgage securitization agencies Fannie Mae and Freddie Mac began offering Enhanced Relief Refinance Mortgages that allow people who have a high loan-to-value (LTV) ratio to refinance so that they can get reasonable payments.

Sell Your Home

There are two options for selling your home with an underwater mortgage. One option is to sell the house and use savings or an additional loan to pay for the difference between your mortgage principal and the home’s sale price. This option could be viable if your mortgage is only slightly underwater, and paying off the difference will not cause financial hardship.

One thing you want to avoid is getting too many additional loans, which could compound your debt issues rather than making things easier.

The other option is to approach your lender about a short sale. A short sale is when the lender sells your home at a loss to avoid the lengthy and expensive foreclosure process. Again, if the mortgage is too far underwater, the lender may prefer to foreclose. However, if there is a relatively small difference between the principal owed and the sale price, a short sale could be a realistic option.

Foreclose on Your Home

In some cases, the last option from a financial perspective is to let the bank foreclose on your home.

When the bank forecloses on your home, you will have to vacate the house, and you will lose any investments that you already made in the property. The lender will then resell the home to try to limit their losses.

This option is only a reasonable one if you have exhausted all other options. A foreclosure will hurt your credit score and force you to find somewhere else to live.

Image Source: https://depositphotos.com/