Your Bank of America routing number varies depending on your state and location.

| State or Region | Bank of America Electronic Routing Number |

| Alabama | 051000017 |

| Alaska | 051000017 |

| Arizona | 122101706 |

| Arkansas | 082000073 |

| California | 121000358 |

| Colorado | 123103716 |

| Connecticut | 011900254 |

| Delaware | 031202084 |

| Washington, D.C. | 054001204 |

| Florida | 063100277 |

| Georgia | 061000052 |

| Hawaii | 051000017 |

| Idaho | 123103716 |

| Illinois (south) | 081904808 |

| Illinois (north) | 071000505 |

| Illinois (Chicago metro area) | 081904808 |

| Indiana | 071214579 |

| Iowa | 073000176 |

| Kansas | 101100045 |

| Kentucky | 051000017 |

| Louisiana | 051000017 |

| Maine | 011200365 |

| Maryland | 052001633 |

| Massachusetts | 011000138 |

| Michigan | 072000805 |

| Minnesota | 071214579 |

| Mississippi | 051000017 |

| Missouri | 081000032 |

| Montana | 051000017 |

| Nebraska | 051000017 |

| Nevada | 122400724 |

| New Hampshire | 011400495 |

| New Jersey | 021200339 |

| New Mexico | 107000327 |

| New York | 021000322 |

| North Carolina | 053000196 |

| North Dakota | 051000017 |

| Ohio | 071214579 |

| Oklahoma | 103000017 |

| Oregon | 323070380 |

| Pennsylvania | 031202084 |

| Rhode Island | 011500010 |

| South Carolina | 053904483 |

| South Dakota | 051000017 |

| Tennessee | 064000020 |

| Texas | 111000025 |

| Utah | 123103716 |

| Vermont | 051000017 |

| Virginia | 051000017 |

| Washington | 125000024 |

| West Virginia | 051000017 |

| Wisconsin | 051000017 |

| Wyoming | 051000017 |

What Is a Routing Number?

Your nine-digit routing number allows financial institutions to identify where your account is located so they can gain access to deposit or transfer funds. You may be asked for your routing number to:

- Facilitate a wire transfer;

- Set up a direct deposit;

- Transfer money from one bank account to another;

- Permit an electronic withdrawal to pay taxes or bills.

Where Can You Find Your Bank of America Routing Number?

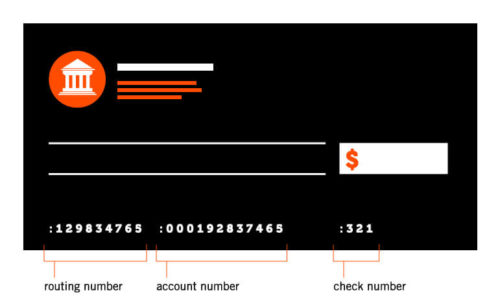

You can find your account’s routing number on your personal checks. When looking at your check, the routing number is the first nine-digit number on the bottom left of the check.

You can also visit the Bank of America website and log into your online account to find your routing number. Additionally, you can use the site to explore credit card options and other offers from the bank.

Providing an accurate routing number is important when a financial institution requests it from you. By giving the correct number, you can ensure you won’t experience delays or canceled transactions.

Image Source: https://depositphotos.com/