Your credit status has a major impact on your life, from your ability to rent or buy a home to whether you can get a vehicle you want. However, many people don’t understand credit or how to monitor their scores. Keeping up with your credit can empower your financial life and help you live better. Here are a few of the best credit app options out there.

Table of Contents

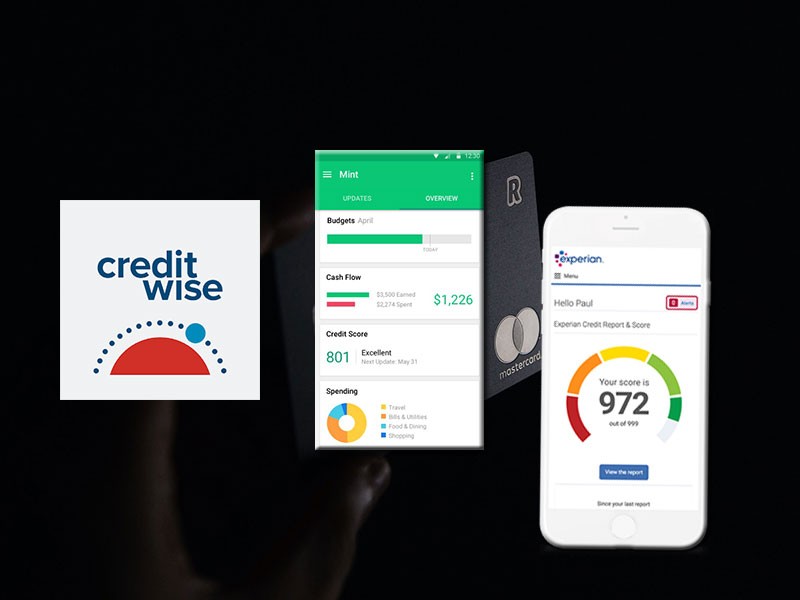

1. Experian CreditWorks Basic

With this tool, you can see your Experian credit report and score once a month. Experian is one of the major credit bureaus that track your credit history and report to lenders, so it’s important to know what the company’s records show about you. It is one of the best credit app choices when you don’t have a complicated financial situation to worry about.

The basic option is free and perfect for easily checking your credit and watching out for any major changes. You also have the option to upgrade to Experian’s premium version if you want more features such as third-party credit monitoring.

Experian CreditWorks is also convenient because you can use an app on your phone, making it simple to check your credit score.

2. Mint

You may be familiar with Mint as an app that helps you track your spending and your budget, but it also is a contender for the best credit app. Mint lets you access your credit score regularly. The app will also send you notices when your credit score changes and make suggestions to help you improve the score.

It breaks down your credit usage, payment history, and more so you can understand what may be holding you back financially.

With Mint, your credit information comes from TransUnion, another one of the major credit bureaus. Seeing scores from different agencies can give you a better idea of how your credit is doing. Mint is also free, making it accessible to anyone with an internet connection.

3. CreditWise From Capital One

While this service is backed by a specific bank, you don’t have to be a cardholder to take advantage of what is one of the best credit app tools out there. CreditWise will provide you with weekly updates about your credit score. This score is your VantageScore 3.0, which is used by many creditors and lenders.

You can also use a simulation tool to see how you can change your credit score. For instance, you can check out how much your score could increase by paying off a certain credit card or how much racking up more credit could lower your score.

4. IdentityForce

For a more comprehensive choice, consider IdentityForce. While it is not free like some of the other best credit app services on the list, it is definitely powerful. You get complete credit monitoring so you will always know your score and if any items are added to your credit report that you were not expecting.

IdentityForce also offers great identity theft monitoring services. These include dark web checks, fraud alerts, and updates on the use of your Social Security number and address.

All these tools combined help you get a complete look at where your credit stands and allow you to protect yourself from any threats that could harm your financial future.

5. Experian IdentityWorks

This is one of Experian’s other offerings, and it is also one of the best credit app options to pick from. A standout of this service is the option to get credit monitoring for an entire family. You may not realize it, but scammers have been known to target children and use their identities for fraudulent purposes.

A plan with Experian IdentityWorks can cover two adults and up to 10 children. That includes dark web monitoring, as well as notifications about the use of Social Security numbers. You can also get identity theft insurance. These plans and options cost more, but they offer great value.

Why Should You Be Monitoring Your Credit With a Best Credit App

While some people take a relaxed approach to monitoring their credit, it is important to stay aware of what is in your reports. Not only does your credit have the potential to hurt your daily finances by raising your interest rates, but it can also impact your future as well.

For example, if you run a business, your credit report can impact your access to the loans you need to grow your business.

Monitoring your credit is also your first line of defense against identity theft, which can cost you lots of money and take years to fix. It is better to prevent problems than to try to solve them later.

How a Best Credit App Can Help With Common Credit Issues

By picking the best credit app for you and understanding your credit report, you can start to take steps to improve your score. There are a few common credit issues that can hold you back. If you have dealt with a credit application or loan denial, it’s time to find out why.

Your credit report will reveal if your debt-to-income ratio is too high. That allows you to make a plan to pay some debts down and improve your score.

Monitoring your credit will also reveal potential errors, like late payments that were wrongly recorded. Late or missed payments hurt your scores, so it is important to dispute them quickly.

Also, take note of the number of inquiries listed on your credit report. When someone accesses your report because you or someone else applied for credit, your credit score can take a temporary hit. Limit how often you apply for new loans or lines of credit, and if you see an unfamiliar inquiry, make sure there is no fraud happening.

Find Resources To Help You Meet Your Financial Goals

Protecting and improving your credit is an important aspect of living your life to the fullest. The process starts with educating yourself by finding the best credit app for your situation so you can stay informed, then finding the right resources to start making changes for the better. If you’re ready to begin a credit repair journey, reach out to Fiscal Tiger to learn how to move forward.